Our Partners

Why Choose GARD?

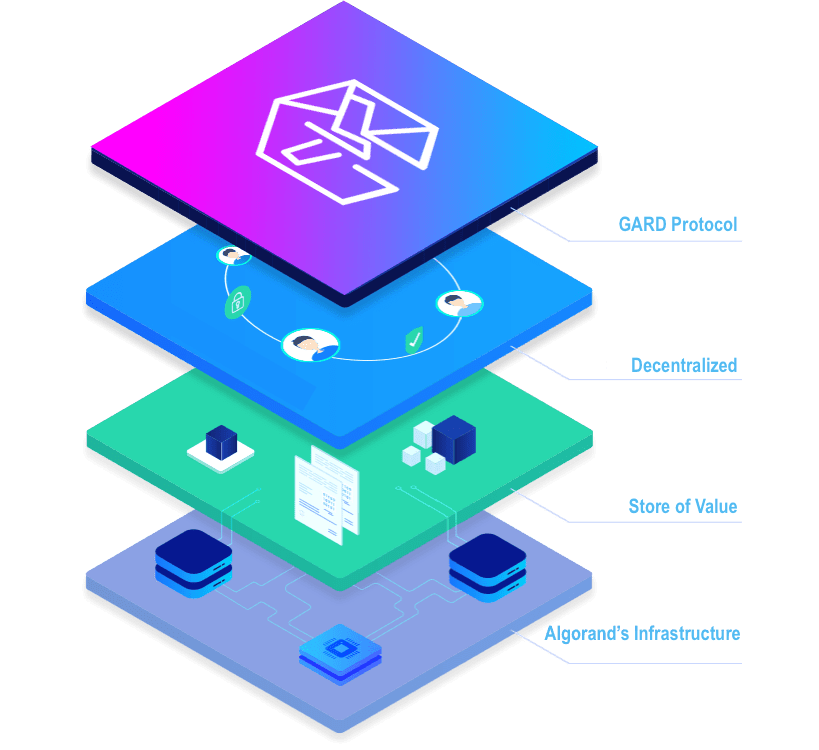

GARD is the logical solution for Algorand DeFi and Algorand Governance participants. The GARD Protocol enables users to both earn rewards and gain tremendous utility. Users of the protocol can earn ownership in it, which will allow them to guide the protocol and shape the future of the broader Algorand ecosystem.

Store of Value

GARD protects the holders’ value by being overcollateralized and using a balancing mechanism. GARD holders will be able to stake their GARD and earn a portion of protocol revenue going forward for added value.

Decentralized

GARD draws liquidity from many different users and may be used by stability seekers and liquidity providers alike. Since day one, the protocol also has committed to distributing ownership in the form of rewards to active participants.

Superior Infrastructure

GARD has instant transactions that are completed for less than a fraction of a penny as facilitated by the Algorand blockchain.

Solutions

We created the first decentralized dollar that is built on the best blockchain, backed by intrinsically valuable capital, and pay users for their liquidity rather than charging them

Unbiased Code:

Proprietary smart-contracts and oracles live on the blockchain and enable equal terms for GARD participation within the Algorand ecosystem.

Safe and Secure:

The security of Algorand, multiple code audits, and redundancies for our servers to protect from DDOS attacks and account hacks.

Stable Value

No matter the price of Algorand, GARD will remain pegged to 1 USD thanks to our proprietary code and balancing strategy.

Borderless Economy

GARD enables real value to be sent anywhere in the world for a fraction of the cost of any other method whether backed by traditional financial systems or crypto. Thanks to GARD a new global economy will be possible

Frequently Asked Questions

How do I participate in DeFi on Algorand?

Algorand DeFi has exploded over the last several years. To participate, simply create an Algorand account (GARD Protocol is compatible with MyAlgo Wallet, Pera Wallet, or AlgoSigner), add some ALGOs, and then connect your wallet to a dApp like GARD Protocol.

What is DeFi composability?

Composability is a core feature of decentralized finance where users can interact with protocols in limitless combinations, stacking activities on top of one another like building blocks. Often referred to as ‘money legos,’ users can deposit assets in a protocol, borrow against them, deposit assets received in another protocol, and earn yield each step of the way. A great thread exploring DeFi composability on Algorand by one of our co-founding investors, David Garcia, can be found here.

What is Yield Farming?

Yield farming involves lending or staking cryptocurrency in exchange for rewards. Yield farmers measure their returns in terms of annual percentage yield (APY). While potentially profitable, yield farming also comes with risks.

What other protocols are in the Algorand DeFi ecosystem?

Algorand has a flourishing DeFi ecosystem. We encourage you to do your own research and to explore projects on the Algorand Ecosystem directory or to get a better picture of projects on DeFi Llama.

What is Algorand Governance?

Algorand Governance enables all ALGO holders with at least one ALGO to vote on the future of the protocol by staking their tokens. This mechanism has helped all of Algorand become similar to a Decentralized Autonomous Organization (DAO) and users who participate are rewarded with more ALGOs. Over time, this process will become more and more efficient, move on-chain, and change Algorand into a true DAO. For more information see our thought piece here.

How to participate in Algorand Governance with DeFi?

Several protocols, including GARD, have enabled users to leverage their ALGOs while still participating in governance. These platforms allow Algorand DeFi users to earn rewards on top of the Algorand Governance rewards. GARD is unique in that it allows users to retain custody of their own ALGOs and vote for whatever measures they see fit rather than delegating their votes. Participating in Algorand Governance with DeFi applications can help users earn more yield than participating in traditional Algorand Governance through the foundation and also comes with additional risks.

How does Algorand Governance work?

Each quarter, governors must promise to maintain a certain ALGO balance in their account to participate in Algorand Governance. During each quarter/period, Algorand Governors must also vote on whatever proposals are brought forward by the Algorand Foundation in order to remain eligible. Governors will receive rewards at the end of each governance period as long as they remain eligible and take the appropriate steps to do so. For more information see our thought piece here.

When does Algorand Governance enrollment start?

The start date for Algorand Governance period #5 is October 1, 2022.

What are algorithmic stablecoins?

Algorithmic stablecoins are crypto tokens that use price stabilization algorithms to maintain the value of an asset, usually at $1, only using software and a set of rules.

How do algorithmic stablecoins work?

Stabilization of algorithmic stablecoins can be achieved by increasing the supply of a token when the value goes up and by reducing it when the price goes down. The rules for such actions by the algorithm are available in smart contracts in embedded form and it is possible to change the rules only by leveraging social consensus or through votes associated with governance or seigniorage tokens.

Setting up your Algorand account

We recommend setting up one of three Algorand wallets that are compatible with the GARD Protocol's web application; MyAlgo Wallet, Pera Wallet, or AlgoSigner. For more information on setting up your wallet we encourage you to watch our tutorial here.

Funding your Algorand account with ALGOs.

You can purchase ALGOs on a centralized exchange like Coinbase and send them to your Algorand account address directly.

Connecting your account to the GARD Protocol's web application.

To connect your Algorand account to the GARD web application, simply click ‘Connect Wallet’ in the upper right corner, agree to the terms of service, select the Algorand account you would like to use, and enter your account’s password. NOTE: We will never ask you for your seed phrase. For more documentation on connecting your Algorand account see our documentation for more details here.